If you’re looking for a life planning technique that is uniquely designed the needs of today’s executive look no further than Reid Hoffman’s brilliant ABZ planning technique, which can help you make the most of the opportunities you will face throughout your career. Hoffman was the cofounder of LinkedIn and created this savvy approach as part of his excellent new book, The Start-up of You: Adapt to the Future, Invest in Yourself, and Transform Your Career .

What is ABZ life planning?

Because change is coming at us so fast today, we need a life planning technique that enables us to maximize our impact in our current position (Plan A), while also clearly see what our next step and pivot to it at the proper time (Plan B) – yet still have a reasonable fallback position if leaving to the next level turns out to be a mistake or failure (Plan Z) – a survivable worst case scenario.

In his book, Hoffman calls ABZ planning the perfect antidote to the traditional What Color is Your Parachute style of planning, which emphasizes doing an inventory of your strengths and then setting goals focused on the types of jobs you would like to acquire.

Hoffman explains the thinking behind his planning framework:

“It is an adaptive approach to planning that promotes trial and error. It allows you to aggressively pursue outside and mitigate against possible downside risks. ABZ planning isn’t something you do once early in your career. It’s a process that’s as important for someone in their 40s or 50s as for newly minted college grad. There is no beginning and middle or end to a career journey; no matter how old you are or at what stage, you will always be planning and adapting.”

Plan A: Your current position

Plan A is what you’re doing right now. It’s your current implementation of your competitive advantage. Within plan A, you make minor adjustments as you learn; you iterate regularly.

Plan B: Your pivot point

Plan B is what you pivot to when you need to change either your goal or the route for getting there. Plan B tends to be in the same general ballpark as Plan A. Sometimes you pivot because Plan A isn’t working; sometimes you pivot because you’ve discovered a new opportunity that’s just better than what you’re doing now.

“Pivoting isn’t throwing a dart on the map and then going there. It’s changing direction or changing your path to get somewhere based on what you’ve learned along the way,” he explains. Once you pivot to a Plan B and stick with it, that becomes your new plan A.

What drives the need to pivot? Hoffman says it’s often caused by an inflection point at your company or in your industry. Such a fundamental change will force you to either change your skills or your environment. How can you tell when such an inflection point will occur? Hoffman acknowledges that it’s unpredictable. That’s why he recommends that you make some moves now to mitigate its impact on you when it does occur:

“Instead of trying to do the impossible and predict when an inflection point will threaten, prepare for the unknown. Build up your soft assets and proactively embrace new technology so that if and when the inflection point does come, you are ready to swiftly parlay skills into a Plan B.”

He says the best Plan B is usually different but very much related to what you’re already doing. Pivoting into an adjacent niche enables you to leverage the skills you are to have while continuing to grow them in a new direction. Often, this can be accomplished during evenings and weekends. You can start learning a skill in your spare time and start building relationships with people who work in the big adjacent industry or niche.

“Why not make this a personal career policy? Set aside one day a week or month or even every few months to work on something that could become part of your plan B,” Hoffman suggests. “Start on it as a side project and see where it goes. Take a day and arrange five coffee meetings with people who work in adjacent industry.”

Plan Z: Your safety net

Plan Z is your fallback position, your lifeboat, and it enables you to tolerate failure and bounce back. “What’s your certain, reliable, stable plan if all your career plans go to hell or you want to do a major life change? That’s plan Z. The certainty of plan Z is what allows you to take on uncertainty and risk in your Plans A and B,” Hoffman explains. “With a Plan Z, you’ll at least know you can tolerate failure. Without it, you could be frozen in fear contemplating the worst-case scenarios.”

You may have to live an austere life for a while as you recover, but at least you know you won’t be homeless, bankrupt of permanently unemployable.

“Plan Z should allow you to retreat, regroup and develop an entirely new plan A. It’s not an end point – it’s what will keep you afloat while you reload and then relaunch yourself on a brand-new voyage, a brand-new Plan A.”

An analogy for ABZ life planning

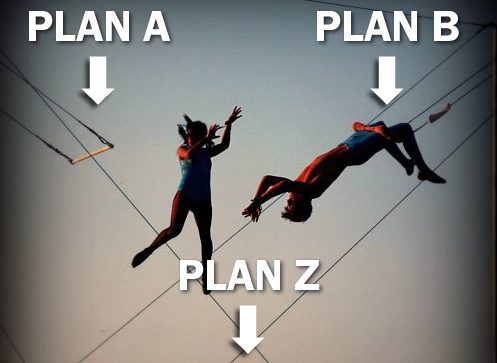

As I thought about ABZ life planning, I wondered if I could come up with a visual metaphor for it. I soon realized that the image of a trapeze artist is perfect:

- Plan A is the trapeze bar you’re currently holding on to.

- Plan B, the related “dream” opportunity you can pivot to when the time is right, is like the trapeze artist on the other bar, who is swinging toward you and will catch you when you leap toward him or her.

- Plan Z is the safety net below you. If you leap and miss your partner’s hands– if plan Plan B fails – you know you won’t be killed or injured by the fall. The safety net gives you the confidence to make the leap.

Why should you use the ABZ technique?

Hoffman points out that the constant presence of risk, especially in today’s uncertain economic environment, makes it imperative that we invest time developing Plans A, B and Z. The idea isn’t to eliminate risk from our lives; that’s impossible, Hoffman points out. Ironically, being risk averse may actually be even more risky today. Rather, he advocates taking a more intelligent approach toward risk, and indicates that will give you a competitive edge.